THE RBI'S BALANCING ACT: HOW MONETARY POLICY SHAPES YOUR FINANCIAL WORLD (RBI Repo Rate & CRR)

- Related toEconomy

- Published on7 June 2025

Have you ever listened to the news and heard terms like “repo rate cut” or “CRR unchanged” and wondered what it all means? Or perhaps you’ve noticed that the interest rate on your home loan or fixed deposit seems to fluctuate over time and felt a bit lost about the forces driving those changes. The Repo Rate and CRR are not just abstract economic headlines; they are the direct results of crucial decisions made by the Reserve Bank of India (RBI), the nation’s central bank. Think of the RBI as the guardian of our economy, performing a delicate balancing act. Its primary goal is to keep prices stable (control inflation) while ensuring the economy has enough fuel to grow. To achieve this, it uses a sophisticated set of tools known as monetary policy. Let’s pull back the curtain and understand how this powerful toolkit works and, more importantly, how it impacts your financial life.

Have you ever listened to the news and heard terms like “repo rate cut” or “CRR unchanged” and wondered what it all means? Or perhaps you’ve noticed that the interest rate on your home loan or fixed deposit seems to fluctuate over time and felt a bit lost about the forces driving those changes. The Repo Rate and CRR are not just abstract economic headlines; they are the direct results of crucial decisions made by the Reserve Bank of India (RBI), the nation’s central bank. Think of the RBI as the guardian of our economy, performing a delicate balancing act. Its primary goal is to keep prices stable (control inflation) while ensuring the economy has enough fuel to grow. To achieve this, it uses a sophisticated set of tools known as monetary policy. Let’s pull back the curtain and understand how this powerful toolkit works and, more importantly, how it impacts your financial life.

The Decision-Makers: The Monetary Policy Committee (MPC)

Before we get to the tools, it’s important to know who wields them. The key decisions on interest rates and monetary policy are taken by a six-member body called the Monetary Policy Committee (MPC). This committee, comprising three members from the RBI (including the Governor) and three external members appointed by the government, meets every two months to assess the state of the economy. They analyze inflation, growth, and a host of other economic indicators to decide the best course of action. Their decisions are what set the direction for interest rates across the entire country.

The Main Lever: Understanding the Policy Repo Rate

The most talked-about tool in the RBI’s arsenal is the Policy Repo Rate.

In simple terms, the repo rate is the interest rate at which the RBI lends money to commercial banks (like the one where you have your account). Think of it as the “wholesale cost of money” for banks.

So, how does this affect you? It creates a ripple effect.

- When the RBI wants to boost the economy: It might cut the repo rate. This makes borrowing cheaper for commercial banks. In turn, banks are encouraged to lower the interest rates on the loans they offer to us—for homes, cars, or businesses. Cheaper loans can encourage people to spend and businesses to invest, giving the economy a push. It’s like the RBI stepping on the accelerator.

- When the RBI wants to control inflation: It might increase the repo rate. This makes borrowing from the RBI more expensive for banks. Consequently, banks increase their own lending rates. Higher EMIs on loans discourage borrowing and spending, which helps to reduce the amount of money circulating in the economy. This cools down demand and helps bring inflation under control. It’s akin to the RBI gently applying the brakes.

The repo rate is, therefore, the primary signal that the RBI sends to the financial system to indicate its policy direction.

The Support System: Other Key Liquidity Tools

While the repo rate is the star player, a whole host of other instruments work in the background to manage the day-to-day flow of money in the banking system. These tools operate within what is known as the Liquidity Adjustment Facility (LAF), which helps banks manage their daily liquidity needs. Imagine a corridor for interest rates; these tools form the ceiling and the floor.

- Marginal Standing Facility (MSF) Rate – The Emergency Window: The MSF Rate is the rate at which banks can borrow money from the RBI overnight in an emergency situation when they are facing an acute cash shortage. This rate is always set slightly higher than the repo rate and acts as the ceiling of the interest rate corridor. It’s a safety valve that prevents inter-bank lending rates from shooting up too high.

- Standing Deposit Facility (SDF) Rate – The Parking Lot: The SDF Rate is the interest rate that the RBI pays to commercial banks for parking their excess funds with it overnight, without needing to provide any collateral. This rate is set slightly below the repo rate and acts as the floor of the corridor. It helps the RBI absorb excess money from the banking system, ensuring that rates don’t fall too low. The SDF was introduced in 2022 and is a powerful tool for liquidity management.

- Bank Rate – The Disciplinary Rate: The Bank Rate is a slightly different tool. It’s the rate at which the RBI is ready to buy or rediscount bills of exchange or other commercial papers. Historically, it was the main policy rate, but now it serves a more specific function. It is the penal rate that the RBI charges banks if they fail to meet their reserve requirements (CRR and SLR). The Bank Rate is aligned with the MSF rate, reinforcing the ceiling of the policy corridor.

The Foundation of Control: Reserve Ratios

Beyond lending and borrowing rates, the RBI has more direct ways to control the amount of money banks can use. These are the mandatory reserve ratios. Think of them as a portion of your savings that you are required to keep aside for safety and cannot use for daily expenses.

Beyond lending and borrowing rates, the RBI has more direct ways to control the amount of money banks can use. These are the mandatory reserve ratios. Think of them as a portion of your savings that you are required to keep aside for safety and cannot use for daily expenses.

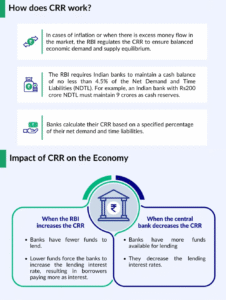

- Cash Reserve Ratio (CRR): This is the percentage of a bank’s total deposits that it must maintain as a cash balance with the RBI. This money earns no interest for the bank. If the RBI increases the CRR, banks have less money available to lend out, which tightens liquidity in the economy. Conversely, a cut in the CRR releases more funds into the banking system, making more money available for loans. For instance, a 1% cut in CRR could release lakhs of crores of lendable resources into the system.

- Statutory Liquidity Ratio (SLR): This is the percentage of a bank’s deposits that it must maintain in the form of safe and liquid assets, such as cash, gold, or government-approved securities. While CRR is about keeping cash with the RBI, SLR is about banks holding secure assets themselves. A higher SLR restricts a bank’s lending capacity, while a lower SLR frees up more funds for lending. It also serves as a buffer, ensuring the solvency of banks.

Influencing from the Outside: Open Market Operations (OMOs)

One of the most powerful and flexible tools at the RBI’s disposal is Open Market Operations (OMOs). This involves the outright purchase or sale of government securities (G-Secs) in the open market by the RBI.

It’s a straightforward mechanism:

- When the RBI wants to inject liquidity into the system, it buys government securities from the market. In doing so, it pays the sellers (banks), and this money flows into the banking system.

- When the RBI wants to absorb liquidity, it sells government securities. Banks buy these securities, and the money they pay flows out of the system and to the RBI.

OMOs are typically used to manage long-term or durable liquidity in the economy, unlike the LAF tools which manage day-to-day liquidity.

The Guiding Star: Flexible Inflation Targeting (FIT)

So, how does the RBI decide when to press the accelerator and when to apply the brakes? Its decisions are guided by a framework known as Flexible Inflation Targeting (FIT).

Adopted officially in 2016, this framework gives the RBI a clear legislative mandate. The government, in consultation with the RBI, sets an inflation target for a five-year period. Currently, the target is to keep retail inflation—as measured by the Consumer Price Index (CPI)—at 4%, with a tolerance band of +/- 2%. This means inflation should ideally remain between 2% and 6%.

The key word here is “Flexible.” While keeping inflation within this band is the primary goal, the RBI must also pay attention to the objective of economic growth. This is the essence of the central bank’s balancing act: fighting inflation without killing growth. If inflation repeatedly breaches the target range for a sustained period, the RBI is accountable to the government and must explain the reasons and the corrective measures it will take.

Reading the Signals: Understanding Policy Stances

Finally, to provide clarity about its future intentions, the MPC announces a “policy stance” along with its rate decisions. This stance gives a signal to the market about the likely direction of future policy.

- Accommodative: This stance indicates that the MPC is willing to cut interest rates to prioritize economic growth, even if it means tolerating slightly higher inflation.

- Neutral: This means the MPC could move in either direction—cutting or increasing rates—depending on how the economic data on growth and inflation unfolds. It signifies a wait-and-watch approach.

- Withdrawal of Accommodation / Hawkish: This stance signals that the central bank’s primary focus is on controlling inflation, and it is likely to increase interest rates or tighten liquidity in the upcoming meetings.

The world of monetary policy, with its various rates, ratios, and operations, might seem complex. However, at its heart, it is a symphony of tools conducted by the RBI to maintain economic stability. From the interest rate on your car loan to the returns on your savings and the overall health of the job market, the ripples of these policy decisions touch every aspect of our financial lives. Understanding this balancing act helps us appreciate the intricate work that goes into keeping our economy on a steady and prosperous path.

Objective of RBI’s Monetary Policy

- Control inflation and promote economic growth

- Uses monetary policy tools to manage money supply

Who Makes the Policy? (Monetary Policy Committee – MPC)

- 6 members: 3 from RBI, 3 appointed by Government

- Meets every two months to decide interest rates based on inflation and growth

Key Tool – Policy Repo Rate

- Rate at which RBI lends to commercial banks

- Repo rate cut → Cheaper loans → Boosts spending and growth

- Repo rate hike → Costlier loans → Reduces spending and controls inflation

Supporting Tools under Liquidity Adjustment Facility (LAF)

Marginal Standing Facility (MSF) : Emergency borrowing rate for banks (higher than repo rate); Acts as upper ceiling of interest rate corridor

Standing Deposit Facility (SDF) : Banks park surplus funds without collateral; Rate is lower than repo; acts as the floor of the corridor

Bank Rate

- Used for rediscounting bills and penal charges

- Aligned with MSF; applies when banks fail reserve norms

Reserve Ratios – CRR and SLR

Cash Reserve Ratio (CRR) : % of deposits kept as cash with RBI; Higher CRR = Less money for banks to lend → liquidity tightens

Statutory Liquidity Ratio (SLR): % of deposits kept in liquid assets like gold, cash, or government securities; Higher SLR = Less funds for lending → reduces credit availability

Open Market Operations (OMOs)

- RBI buys/sells government securities in the open market

- Buying G-Secs → injects money into the system

- Selling G-Secs → absorbs excess liquidity

Flexible Inflation Targeting (FIT)

- Adopted in 2016 with inflation target of 4% ± 2%

- RBI must explain if inflation stays out of this range for long

- Aims to balance inflation control with economic growth

Policy Stances Explained

Accommodative – RBI prefers rate cuts to support growth

Neutral – RBI may hike or cut depending on economic trends

Withdrawal of Accommodation / Hawkish – RBI likely to raise rates to control inflation

Loved this article? Go to Learning EDGE+ Page↗️